Discover tailored strategies for success with expert business consulting in UAE. From market entry to compliance, No Cap Consulting helps...

Enhancing Productivity and Ethical Hiring Practices

Discover how integrating Environmental, Social, and Governance (ESG) strategies into recruitment can drive business success and sustainability in the GCC. Learn how ESG practices not only attract top talent but also enhance your company’s reputation and long-term growth.

In today’s rapidly evolving business landscape, Environmental, Social, and Governance (ESG) criteria have become critical to a company’s success. For companies in the GCC region, integrating ESG into the recruitment process not only enhances effectiveness but also attracts top talent, secures funding, wins tenders, and successfully executes projects. Here’s why ESG matters and how it can transform your business.

ESG criteria are no longer optional; they are essential for businesses aiming to thrive in the modern economy. Companies that prioritize ESG are better positioned to attract and retain talent, achieve long-term growth, and enhance their reputation. Here’s how ESG integration in recruitment benefits your business.

Today’s job seekers, particularly millennials and Gen Z, prioritize working for companies that demonstrate a commitment to ESG principles. According to a survey by Cone Communications, 64% of millennials consider a company’s social and environmental commitments when deciding where to work, and 83% would be more loyal to a company that helps them contribute to social and environmental issues (Cone Communications, 2016).

Pain Point Addressed: Many companies struggle to attract talented individuals who align with their values. Emphasizing your ESG efforts in job postings and interviews can make your company more attractive to top-tier candidates. By showcasing your commitment to sustainable practices, ethical governance, and social responsibility, you not only appeal to potential employees’ values but also create a work environment that promotes loyalty and satisfaction.

Integrating ESG into your recruitment process can lead to a more motivated and productive workforce. Employees who believe their employer is committed to ESG are more engaged and loyal. According to the Harvard Business Review, companies with high employee satisfaction scores have outperformed their peers by 2.3% to 3.8% per year over a 28-year period (Harvard Business Review, 2011).

Pain Point Addressed: Employee disengagement is a common issue that affects productivity. ESG integration fosters a sense of purpose and belonging among employees, enhancing overall company effectiveness. By creating a work environment where employees feel valued and part of a larger mission, you can reduce turnover and increase job satisfaction.

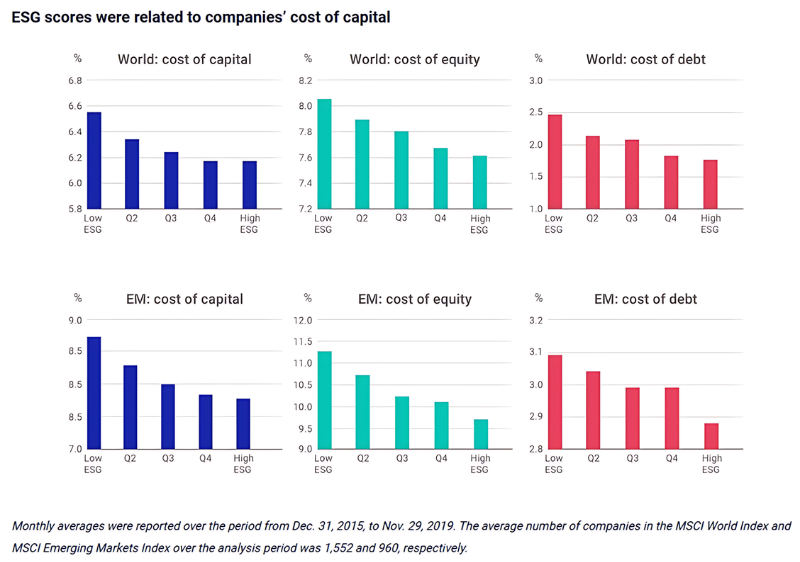

ESG practices are increasingly viewed as indicators of a company’s long-term viability and risk management. Investors and stakeholders are more likely to support businesses with strong ESG credentials. According to MSCI, companies with high ESG ratings have a lower cost of capital and are better at managing risks and opportunities (MSCI, 2020). ESG criteria are now critical in capital allocation decisions, with investors favoring companies that demonstrate sustainability and ethical practices.

Pain Point Addressed: Securing funding and winning projects can be challenging for many businesses. Demonstrating a commitment to ESG can significantly improve your chances of success in these areas. By integrating ESG criteria into your business model, you attract investors who are looking for sustainable and socially responsible investment opportunities.

Equity, Diversity, and Inclusion (EDI) are integral components of the Social aspect of ESG. Companies that prioritize EDI not only comply with ethical standards but also benefit from diverse perspectives and a more inclusive workplace culture. Diverse teams are more innovative and better at problem-solving, which is crucial for business success. According to McKinsey, companies in the top quartile for ethnic and cultural diversity on executive teams were 33% more likely to have industry-leading profitability (McKinsey & Company, 2020).

Pain Point Addressed: Many companies struggle with fostering diversity and inclusion. By integrating EDI principles into your ESG strategy, you create a more dynamic and innovative work environment. This approach not only enhances your company’s performance but also ensures that you are compliant with social expectations and regulations regarding workplace diversity.

Employee wellbeing has become a global trend and a critical component of the Social aspect of ESG. Businesses that focus on employee wellbeing see improved performance, reduced absenteeism, and higher job satisfaction. This trend is especially relevant in the GCC region, where companies are increasingly recognizing the importance of supporting their workforce’s mental and physical health. A study by Gallup found that highly engaged teams show 21% greater profitability (Gallup, 2020).

Pain Point Addressed: Employee burnout and low morale are common issues that impact productivity. By prioritizing employee wellbeing, you create a healthier, more resilient workforce. Implementing wellness programs, offering mental health support, and ensuring a healthy work-life balance can significantly enhance employee satisfaction and performance.

ESG considerations have become central to capital allocation decisions. Investors are increasingly looking for companies that demonstrate strong ESG performance, as these companies are perceived to be more sustainable and less risky. Companies with high ESG ratings attract more investment and enjoy lower costs of capital. This shift is driven by the growing recognition that ESG factors are critical to a company’s long-term success. According to a study by Deutsche Bank, companies with high ESG scores had lower volatility, higher returns, and lower cost of capital (Deutsche Bank, 2012).

Pain Point Addressed: Traditional investment strategies often overlook the long-term risks associated with poor ESG practices. By integrating ESG into your business model, you can attract a broader range of investors and secure more favorable financing terms.

The International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI) provide frameworks for ESG reporting. These frameworks help companies measure and report their ESG performance in a standardized way, making it easier for investors and stakeholders to assess their sustainability. Additionally, third-party rating agencies like MSCI and Sustainalytics offer independent evaluations of a company’s ESG practices, helping investors make more informed decisions.

Pain Point Addressed: Many companies struggle with the complexity of ESG reporting. Using standardized frameworks and third-party ratings, businesses can provide transparent and credible information about their ESG performance, enhancing their attractiveness to investors.

Greenwashing, or the practice of making misleading claims about a company’s environmental practices, is a significant concern in sustainability. Research centers worldwide are focused on this issue, emphasizing the need for transparency and accountability. Professionals in the field, such as Dr. Fatima Al Mulla from the GCC, Dr. Jane Goodall, and Michael Bloomberg, advocate for stringent regulations and honest reporting to combat greenwashing.

Pain Point Addressed: Greenwashing can damage a company’s reputation and undermine trust. By committing to genuine ESG practices and transparent reporting, businesses can build trust with stakeholders and avoid the pitfalls of greenwashing.

Politicians worldwide have varying views on ESG, with some advocating for stronger regulations and others resisting these changes. In the USA, for example, there is ongoing debate over ESG-related bills. Proponents argue that ESG regulations protect investors and promote sustainable business practices. Critics, however, claim that these regulations could impose additional costs on businesses and negatively impact economic growth, particularly for smaller companies and poorer communities.

Pain Point Addressed: The political debate over ESG highlights the challenges and opportunities for businesses. While some argue that ESG regulations can be burdensome, others believe that they are essential for promoting long-term sustainability and social responsibility.

Artificial Intelligence (AI) is set to revolutionize how we approach ESG. AI can help companies collect and analyze vast amounts of data, providing deeper insights into their ESG performance. By automating ESG reporting and using AI to identify trends and risks, businesses can make more informed decisions and enhance their sustainability efforts. Companies like IBM and Microsoft are already using AI tools to gather and analyze ESG data, setting new standards for efficiency and accuracy.

Incorporating ESG into your recruitment process and overall business strategy is not just a trend—it’s a necessity for companies looking to thrive in the modern economy. By attracting top talent, enhancing company effectiveness, and leveraging ESG for funding and projects, you position your business for long-term success.

Moreover, integrating EDI and prioritizing employee wellbeing further strengthens your ESG credentials, making your company more attractive to potential employees and investors alike. For businesses in the GCC region, focusing on ESG is a powerful way to drive growth, innovation, and sustainability.

Ready to enhance your business with a strong ESG framework? Contact us today to learn how we can help you integrate ESG principles into your recruitment process and overall business strategy.

Discover tailored strategies for success with expert business consulting in UAE. From market entry to compliance, No Cap Consulting helps...

In the UAE’s dynamic business environment, employee wellness is more than just a trend—it's a key driver of brand success....

In 2024, mastering the UAE recruitment landscape requires deep local expertise. This guide highlights the importance of understanding cultural nuances,...

As AI continues to reshape recruitment in the GCC, ethical considerations are more crucial than ever. This article delves into...

Always here to support your growth and success.

© 2020 -2024 No Cap LLC